10 Ways For Traders to Take Profit

10 Distinct ways For Sellers to Take Advantage

10 Different ways For Dealers to Take Benefit

Taking your advantages is just probably as critical as your trade areas. Coming up next are 10 unique ways for you to comprehend your trading benefits.

Taking advantage is one of the most excused point among sellers. The normal learning cycle comes these lines.

Dealer believes that the trade area is the main thing that is in any capacity significant.

Dealer debilitates his trading capital and comprehended that he has ignored stop-setbacks. Time to focus in on stop-hardships.

Seller feels frustrated when he sees his paper benefits vanish again and again. Truly around then, he comprehends that while he has a leave plan for losing trades, he doesn't have one for winning trades.

Without knowing how to take benefits, a trader will not at any point be useful. Make an effort not to dismiss this fundamental piece of trading any longer.

Coming up next are 10 methodologies for grabbing benefits off the table.

Targets

1. Chart Pattern Target Projection

2. Fibonacci Extension

3. Past Swing Turns

4. Price Channel

5. Time Target

Trailing Stop-Losses

6. Parabolic SAR

7. Chandelier Stop

8. New Trading Signal

Ongoing Price Action

9. Reversal Signal

10. Climatic Move

Targets

The most prompt strategy for taking advantage is to use an objective end demand. This truly plans that as we enter a trade, we put in an end demand at an expense objective.

How might we choose the goal cost?

For the specific shipper, there are a couple of reliable decisions.

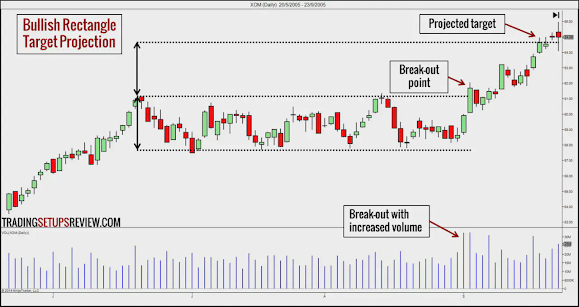

1. Chart Model Objective Projection

A key objective projection methodology uses conventional chart plans as a reason. These framework plans consolidate Triangles, Square shapes, Head and Shoulder, from that point, anything is possible. If you use frame plans in your trading, why not use them to broaden concentrates too?

Despite the way that we draw each outline plan unexpectedly, the objective projection system is equivalent. It for the most part incorporates taking the level of the chart plan and widening it from the break-out point.

The model under advises the most ideal way to broaden a bullish goal from a Square shape frame plan.

(For quick and dirty steps of expanding centers from other outline plans, insinuate our 10 Diagram Models for Worth Action Trading.)

Diagram Model Objective Projection (Square shape)

To broaden the goal in this model:

Measure the level of the Square shape plan; and

Project a comparable detachment from the break-out point at the most noteworthy mark of the Square shape to get the bullish goal.

Essentially, we can appear at a negative objective if we project the level of the Square shape from its base.

2. Fibonacci Extension

Other than relying upon numerical chart plans, vendors also use the splendid extent to project targets. The splendid extent is immovably associated with the Fibonacci progression which is a common trading premise.

Fibonacci sellers includes Fibonacci Increases for projecting targets. Using an illustrating programming with Fibonacci drawing instruments, you can stamp these possible goal levels easily.

Fibonacci Increase Target Projection

As shown above, drawing Fibonacci Extensions is a two-step process.

Recognize a basic inspiration move. In this model, we want to find a bullish goal. Subsequently, we picked a bullish inspiration swing.

Project the increases using Fibonacci extents (0.382 and 0.618). For instance, copy the level of the inspiration wave by 0.382. Then, at that point, widen the thing from the high of the drive swing.

For Fibonacci Expansions, the choice of the inspiration wave is essential. Select a sensible and massive expense push for best results.

3. Past Swing Turns

Swing turns are market pivotal occasions. These vital crossroads are practical assistance and check levels, especially those at huge market tops and bottoms.

Consequently, by expanding them into the future, we get reliable expense targets.

Generally, we look for negative targets using past swing lows and bullish ones with swing highs.

Taking Advantages with Swing Lows

This model shows a short trade. Using past swing lows, we projected a couple of block levels tending to potential targets. The nearest impediment is evidently the most protected objective.

Seeing past swing turn centers is an unmistakable and energetic strategy for finding help/resistance.

4. Price Channel

An expense channel includes two equivalent lines. The possibility of the channel depends upon its grade.

Lines incline upwards - Bull channel

Lines incline downwards - Bear channel

Lines are even - Trading range

Jump further into trading with channels with this article.

Bull Channel Target

The framework above shows a NR7 long plan. We projected a goal using an expense channel.

Draw an upwards inclining design line with two swing lows.

Characterize an equivalent limit starting from the most recent high. (Channel line)

The game plan is to exit once cost causes an uproar in and out of town line. As the market propels, the channel line rises. Thusly, our goal cost is dynamic, and we need change the goal demand higher to remain mindful of the channel line.

This is as an unmistakable contrast to the systems we inspected previously. They are static targets which don't need changes.

Similarly, as shown underneath, a channel procedure is the standard choice for dealers working inside a trading range, pulling out all the stops.

Trading Arrive at Routes out

5. Time Target

Could we look at centers from another viewpoint. Endeavor time.

Having time targets imply taking advantages once a particular period of time has sneaked past. This methodology for taking advantage is significant and perhaps essential for decisions dealers and casual financial backers.

Decisions agents (expressly buyers) need to manage their chance of gains versus expected mishap in light of time decay. Typically, the lack of time regard propels as we approach the decisions pass date. Thusly, having a period target is useful for dealing with the issue of time decay.

Most casual financial backers work inside the constraints of a lone trading meeting to appreciate intra-day trading edges and to avoid for now risk. Taking everything into account, there is a trademark time center close to the completion of each and every gathering.

Join a period center with an expense center for the best situation.

Following Stop-Incident

Permit your advantages to run.

I'm sure you have heard this precept already. In the event that you want to adhere to this trading urging, using a following stop-disaster is your most brilliant choice.

A following stop-setback is one that follows behind the market. It has the twofold ability of getting in benefits and permitting advantages to run.

Regardless, the specialty of following stop-incident is mentioning. If we trail the stop-adversity demand too eagerly, we could stifle out the trade. In case we trail it unnecessarily a long ways behind the market, we risk presenting back a gigantic piece of our advantages.

For an exact way to deal with following stop-incidents, use one of the going with systems.

6. Parabolic SAR

J. Welles More stunning imagined the ADX for following patterns and the RSI for explaining energy. It is not really shocking that he has something at his disposal for following stop-misfortunes.

Allow us to present More out of control's Illustrative Pause and-Opposite (SAR).

From its name, we can tell that plainly, More stunning expected to involve the Allegorical SAR for something other than following stop-misfortune. He needed to invert the exchanging position subsequent to being halted out.

Be that as it may, here, we are just zeroing in on involving it as a following stop-misfortune device to secure in our benefits.

This pointer plots a marker underneath each cost bar in an upturn or more each bar in a downtrend. Its fundamental idea is that time is cash. Thus, over the long haul, the Explanatory SAR speeds up nearer to the market cost.

Following Stops with Allegorical SAR

In this model, our entrance was the bullish pin bar (doji). The blue dabs plot the Explanatory SAR, which gives a characteristic following stop-misfortune for our long exchange.

Towards the right of the outline, you could see that the blue specks are bigoted of delayed sideways development, and makes up for lost time rapidly.

The specific computation of the Explanatory SAR is slightly convoluted. If you have any desire to sort it out, the best asset is More stunning's New Ideas in Specialized Exchanging Frameworks.

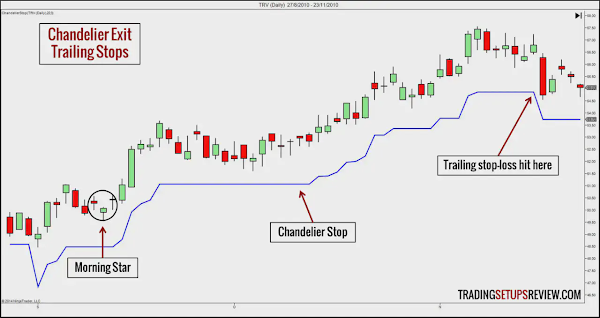

7. Chandelier Stop

The ideal following stop-misfortune ought to give adequate space for minor pullbacks. Subsequently, a reasonable methodology is to consider the way in which unpredictable the instrument is.

The Light fixture Stop does that by taking the Typical Genuine Reach (ATR) as a proportion of unpredictability. The ATR is one more idea from More stunning. (Indeed, we are truly obligated to him.)

Basically, the ATR estimates instability utilizing the typical scope of each cost bar and adapts to any holes. If you have any desire to see the equation, it's here.

Crystal fixture Stop (Long Position) = Most elevated High of a Period - (Different x ATR over a Period)

Ceiling fixture Hold back (Position) = Most minimal Low of a Period + (Different x ATR over a Period)

You really want to settle on two sources of info: Period and Different. A typical setting is a Time of 22 and a Different of 3.

To find out where to put our stop-misfortune, duplicate the ATR(22) by 3. Then, short that item from the most noteworthy high of the beyond 22 bars for a bullish objective.

The model underneath shows the utilization of a Crystal fixture Stop (in blue) for a Morning Star candle signal.

Following Stops with Ceiling fixture

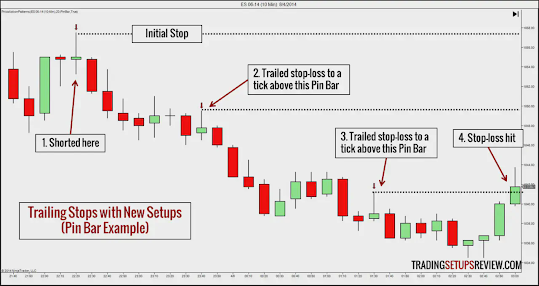

8. New Trading Signal

The essential thought is to trail stop-misfortunes behind new exchanging arrangements that structure your exchange's bearing.

This is an optional method. It can take different structures depending the arrangements that get your eyes. That's what simply recall whether the arrangement is adequate for another exchange a similar bearing, it is an adequate reason for us to change our stop-misfortune.

The model beneath utilizes Pin Bar signs to trail stop-misfortunes. Yet, you can basically utilize any value example or pointer signal you are know all about.

Following Stops with Pin Bars

We set apart out the Pin Bars in the diagram above with our Value Activity Example Pointer.

Progressing Value Activity

We covered taking benefits with an objective breaking point request. We have likewise discussed assuming benefits with stop-misfortune orders.

Presently, how about we perceive how we can take benefits with market orders. This is an adaptable way to deal with choose if we really want a quick exit to keep our benefits.

9. Reversal Signal

This is the rational exit.

Enter with a bullish sign. Take your benefits with a negative sign.

Short with a negative sign. Cover with a bullish one.

This a deft strategy. In any case, in moving business sectors, this technique could cause untimely exits and cutoff our benefits. This is on the grounds that a pattern supports itself by giving misleading inversion signs to trap brokers out of the market and have them pursue it.

In the model beneath, we entered with a negative Immersing candle. Then, a bullish Inundating design provoked us to take benefits.

Taking Benefit with Inversion Signs

10. Climatic Move

Climatic cost activity is an inversion signal that is especially viable as a benefit taking prompt.

Pay special attention to:

Bar range extension

Cost development at a rising rate

Outrageous volume

Taking Benefit with Peaks

This graph shows an instance of leaving at the market following a climatic move.

We shorted at this negative Inversion Bar.

Cost fell with an illustrative bend.

Simultaneously, volume increments.

The above indications of a climatic move provoked us to cover our short position.

After a peak, the market tends move sluggishly (as above) or switches pointedly.

Reward 11 - Point and Figure (P&F) Graph Target Projection

P&F is an exceptional diagram type that centers just around value activity and channels out little cost developments (commotion). For a prologue to P&F outlining, read this part of our manual for cost diagram types.

It has its own arrangement of diagram examples and remarkable objective projection techniques including the flat counts and vertical counts.

As P&F outlines utilize unadulterated cost activity, it could offer a more dependable cost objective. At any rate, it allows us a second assessment for focusing on.

In the event that you are quick to find out more, get a duplicate of Jeremy du Plessis' book on P&F diagramming.

The Ideal Exchange Exit

There you go, ten methods for exitting your exchanges with a benefit.

How would we choose these strategies? Think about the accompanying.

Exchanging Style (Pattern or Reach)

Allow your exchanging to style decide your predisposition towards target requests or following stop-misfortunes.

To allow benefits to run, use following stop-misfortunes. (Like the Turtles who pause and opposite with every open door.)

In the event that you scalp for little benefits inside an exchanging range, use target orders.

The reason of reach exchanging is that the market is inside an exchanging range. It follows that the exchanging range restricts our benefit potential. Thus, utilizing following stop-misfortunes to allow benefits to run is conflicting.

Exchanging Time span

Your exchanging time skyline is likewise a key thought.

Informal investors will profit from having objective orders. The scope of every meeting limits their benefit potential. Confronting such cutoff points, there is little point in allowing benefits to run with following stop-misfortunes. Target orders are reasonable.

In the event that you can clutch positions without time requirements, then, at that point, following stop-misfortunes may be ideal.

Search for Juncture of Targets

For those utilizing objective breaking point orders, find the best cost targets utilizing the idea of juncture.

This intends that in the event that you get a Fibonacci expansion focus on, a graph design estimated target, and a significant swing turn grouping around a cost level, you grin.

Wonderful Objective? Awaken.

Attempting to search for the ideal exit is basically as hazardous as endeavoring to track down the Sacred goal of the ideal passage.

There is no such thing as it, and you won't ever be blissful in the event that you pursue it. You will wind up harming your exchanging execution.

.jpg)

0 Comments